About Us

How It Works

We provide an award-winning personalised mortgage experience by matching you to one of our specialist Mortgage Experts based on your unique situation.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Exclusive broker partner to

How It Works

How Much Does It Cost?

Your mortgage advice fee depends on your individual circumstances. We’ll always confirm the exact amount before you choose to proceed. If we’re unable to help you secure a mortgage, you won’t pay anything.

Commitment Fee

100% Refundable

After your initial consultation, if we’re confident we can help, we’ll ask for a £99 commitment fee to begin the process.

This amount is deducted from your final fee.

It is fully refundable if we cannot arrange a suitable mortgage for you.

Offer Fee

Paid upon Successful Offer

Once we’ve found and you’ve agreed to a suitable mortgage offer, an Offer Fee becomes payable.

The amount depends on your circumstances and the complexity of your case.

We’ll confirm the exact fee in writing before you proceed.

Total Fee

Maximum £1,599

For new customers, our maximum total fee is £1,599, including the refundable £99 commitment fee.

For returning customers or those arranging a product transfer, the total fee is up to £599, including the refundable £99 commitment fee.

Fees are only payable on completion and will always be confirmed in your personalised illustration (Key Facts Illustration) before you apply.

How It Works

Why We’re Different

Traditional lenders and automated online mortgage platforms typically reject borrowers if they have a less-than-typical income or have a history of bad credit. We know that a growing number of people are working in less conventional ways and that life isn’t always straightforward. With the right experts, there are nearly always possibilities.

How It Works

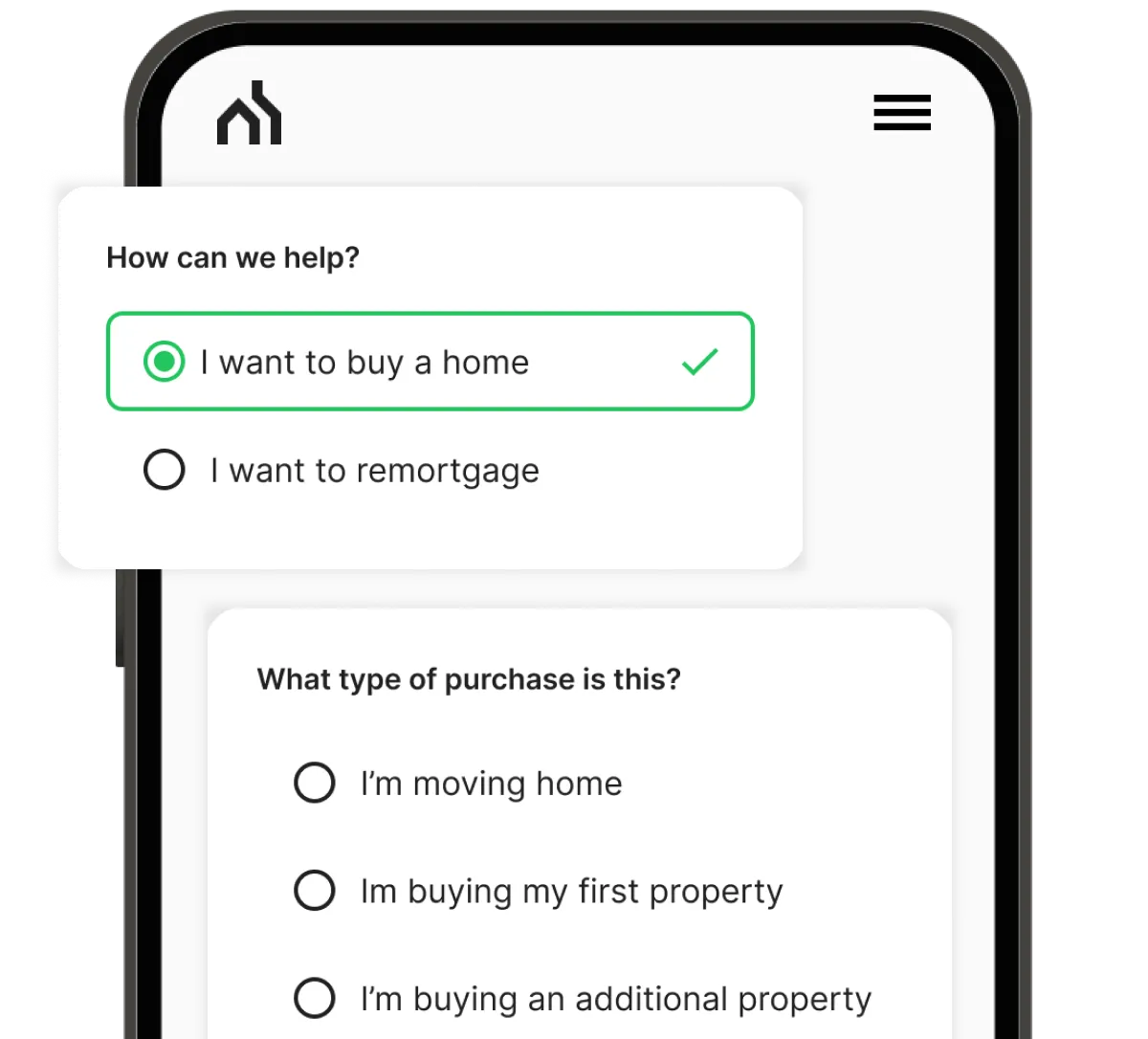

Three steps to make your mortgage possible - with expert guidance and an innovative process designed to support you every step of the way.

Get Started NowTell Us About You

Fill out a quick 60-second form about your unique situation. It won’t affect your credit score.

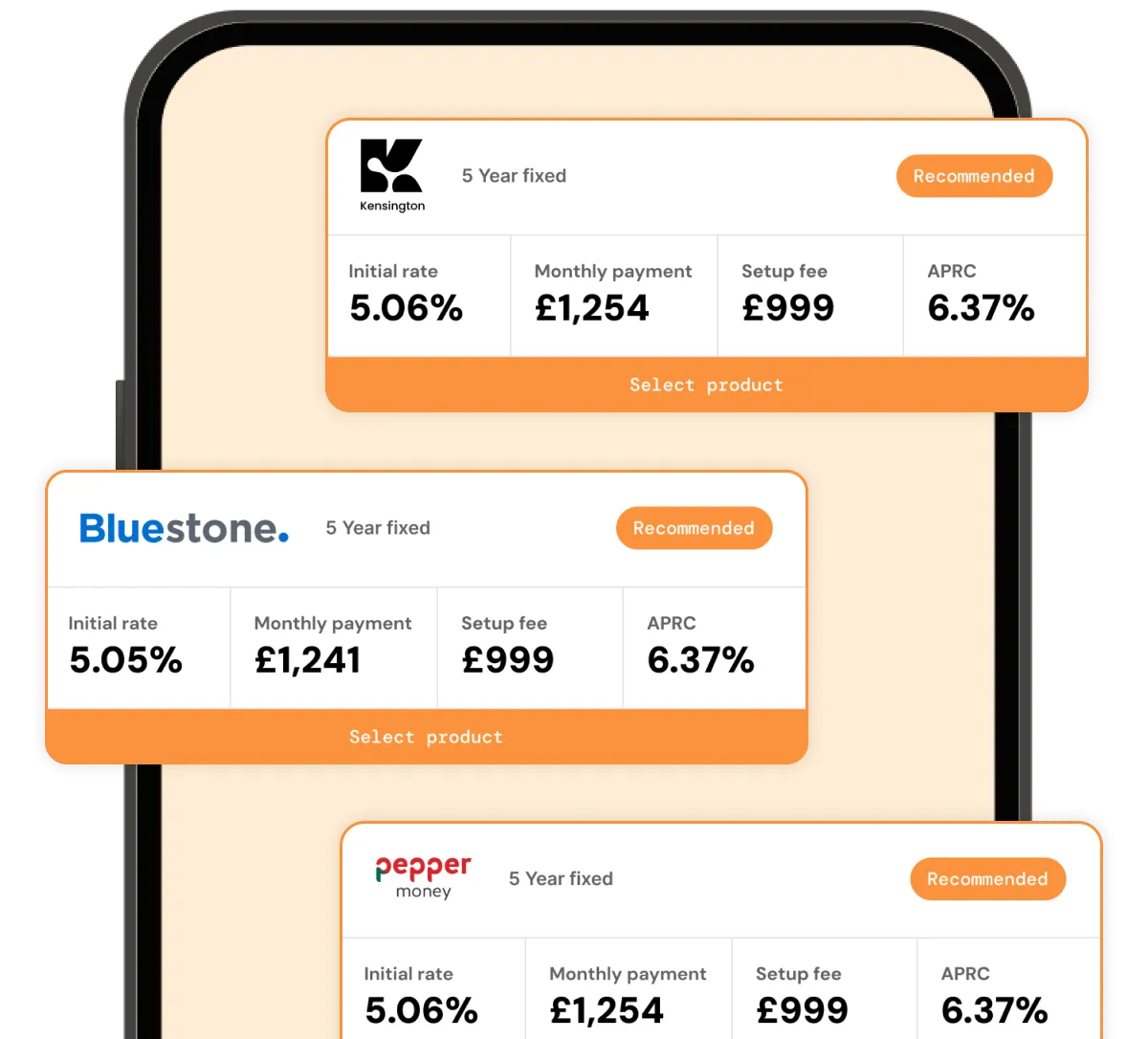

Mortgage Match

We have access to over 100 lenders, including options only available through specialist brokers, to find the best fit for you.

Meet Your Experts

Get paired with your dedicated team who'll handle everything from start to finish. Track progress 24/7 in your customer portal - no messy paperwork!

Powered By

We’ve built the first end-to-end platform to handle the most complex cases. It powers everything we do, no matter how complicated, empowering our experts to focus on what really matters. Less admin, less paperwork, and more time working with our customers to make mortgages possible.

How It Works

Our Mortgage Advisors

All our Mortgage Experts are fully qualified with experience in bad credit, self-employed and complex mortgages. They all have a proven track record of getting mortgages for people who’ve been rejected elsewhere.

We use the information from your enquiry to match you with the best Mortgage Expert for your situation.

About Us

Who We Are

We’re here to make mortgages possible for everyone - no matter how complicated it seems. Check out Our Story to see how we’re changing the game, get a glimpse of our transparency in Our Promise, and dive into expert tips in Our Blog, even explore joining our team in Careers.

Our Story

Jonny and Paul’s story is the heart of why Haysto was created - to fight for people who've been unfairly turned away by lenders.

Our Promise

Making mortgages possible is what we do. Our promise is to streamline your mortgage journey, giving you complete peace of mind.

Our Blog

Find the latest on what we're up to, what's going on in the mortgage world, and some other bits we think you'll find interesting.

Careers

Unlock your potential with a career at Haysto - an innovative, compassionate and disruptive company.

Information

Tools & Guides

Haysto, a trading style of Haysto Ltd, is an appointed representative of HL Partnership Limited, which is authorised and regulated by the Financial Conduct Authority.Registered Office: Haysto, Crystal House, 24 Cattle Market Street, Norwich, NR1 3DY. Registered in England and Wales No. 12527065

There may be a fee for mortgage advice. The exact amount depends upon your circumstances but will range from £599 to £1599 and this will be discussed and agreed with you at the earliest opportunity.

The guidance and/or information contained within this website is subject to the UK regulatory regime and is therefore targeted at consumers based in the UK.

Your home may be repossessed if you do not keep up repayments on your mortgage.