How To Send Us Your Credit Report - 3 Easy Steps

Having an up-to-date credit report is important when you’re applying for a mortgage. You and your Mortgage Expert can then see what the mortgage lender will see. Here’s how to download and send us your report in 3 easy steps.

Exclusive broker partner to

2 mins

Updated: Dec 2 2024

2 mins

Updated: Dec 2 2024

Please be aware that by following any external links you are leaving the Haysto website. Please note Haysto nor HL Partnership Limited are responsible for the accuracy of the information contained within external websites accessible from this page.

On this page

We recommend taking advantage of Checkmyfile’s 30-day free trial* (usually £14.99 a month). You’ll get a really thorough overview of your credit report with a detailed look at your credit history. Their report will show what you look like at each credit reference agency side by side.

*When you click through to our affiliate links, we may earn a small commission at no extra cost to you. We only recommend sites we trust and believe in.

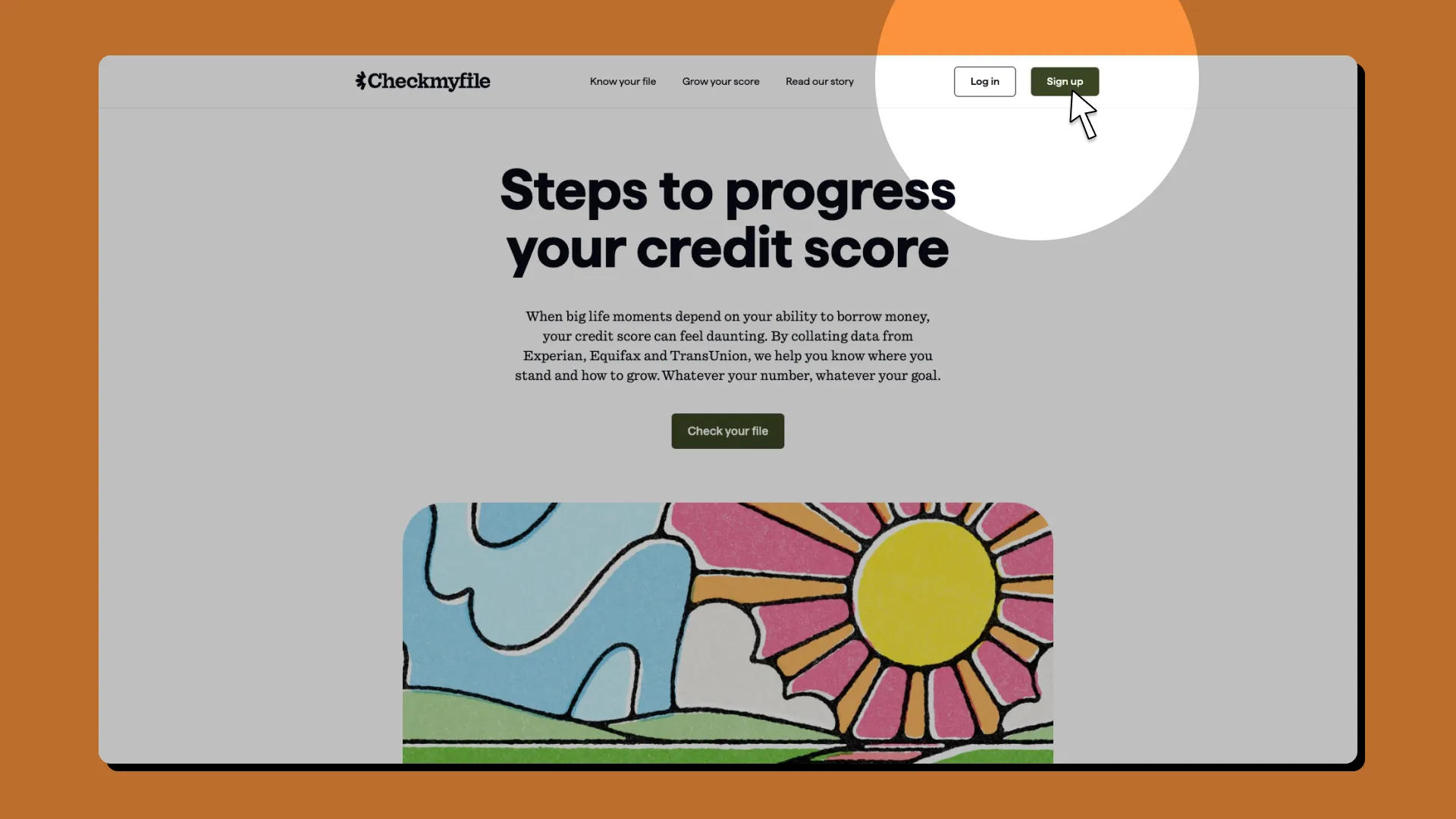

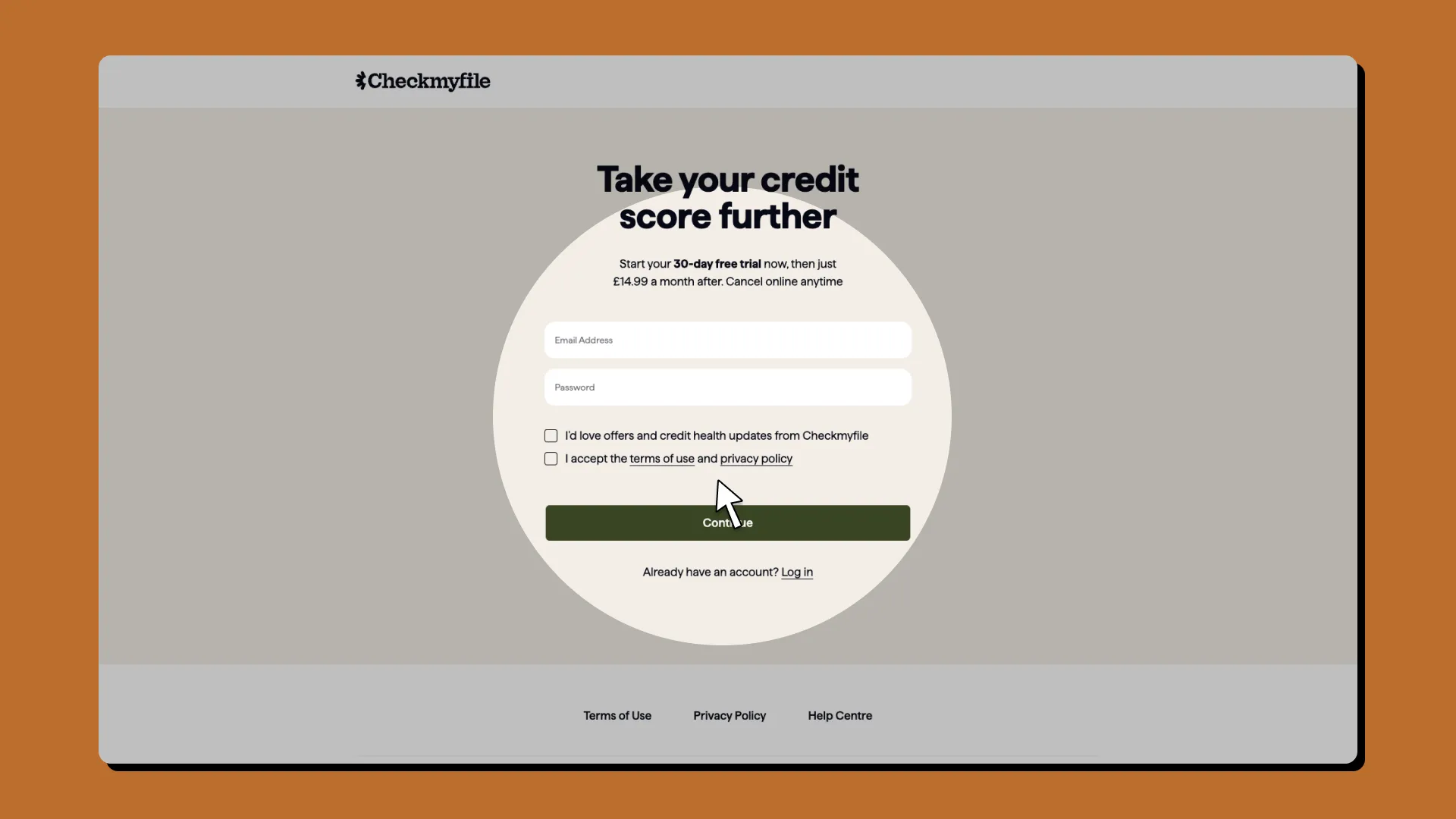

Step 1: Sign up to Checkmyfile

If you haven’t already, you’ll need to sign up to Checkmyfile to view your online credit report before you can download it. It takes less than five minutes, and you’ll get a free 30-day trial, which you can cancel at any time.

Already signed up? Just log into your account and reactivate your subscription (£14.99 per month) to make sure you have your most up-to-date report.

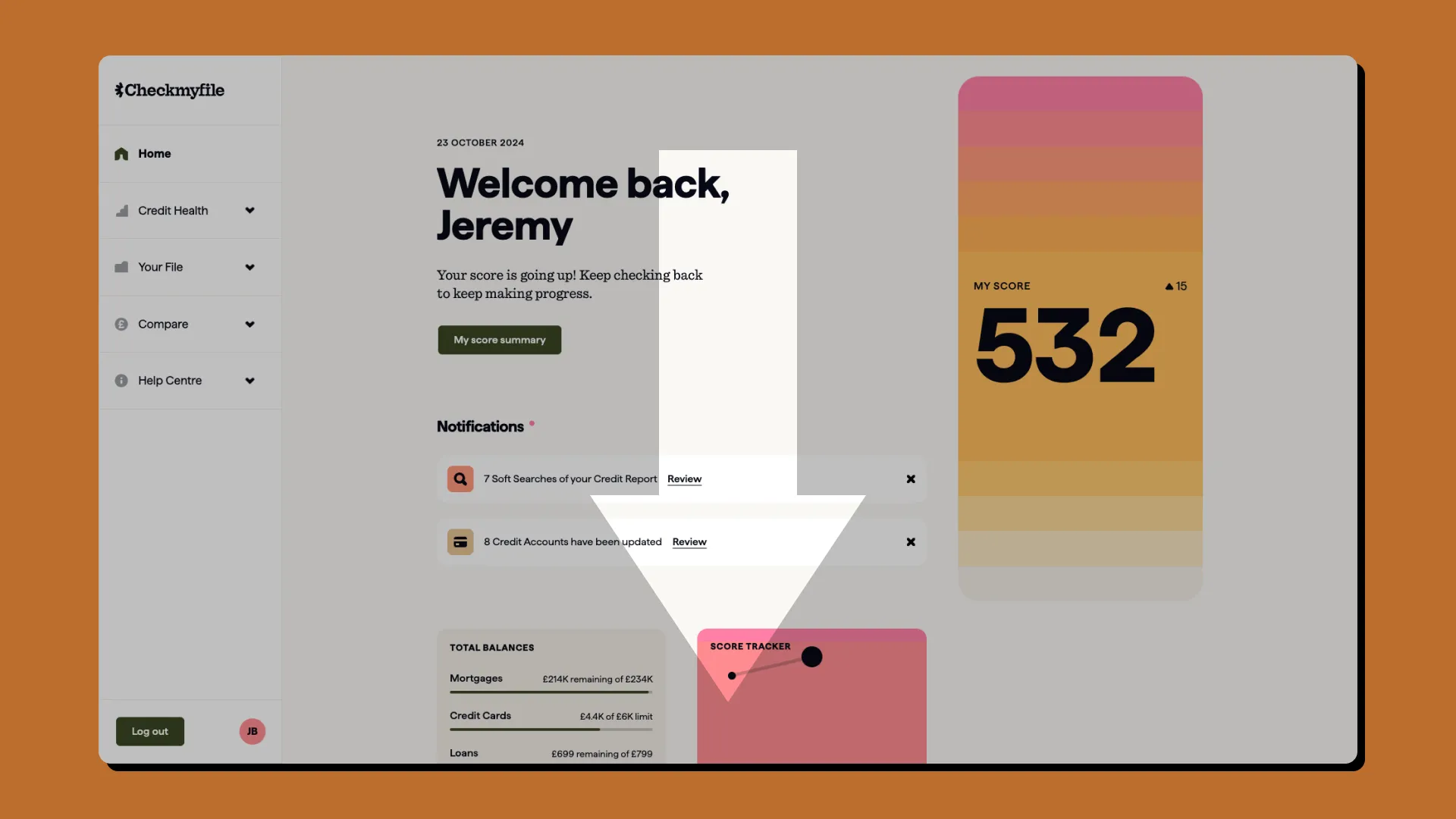

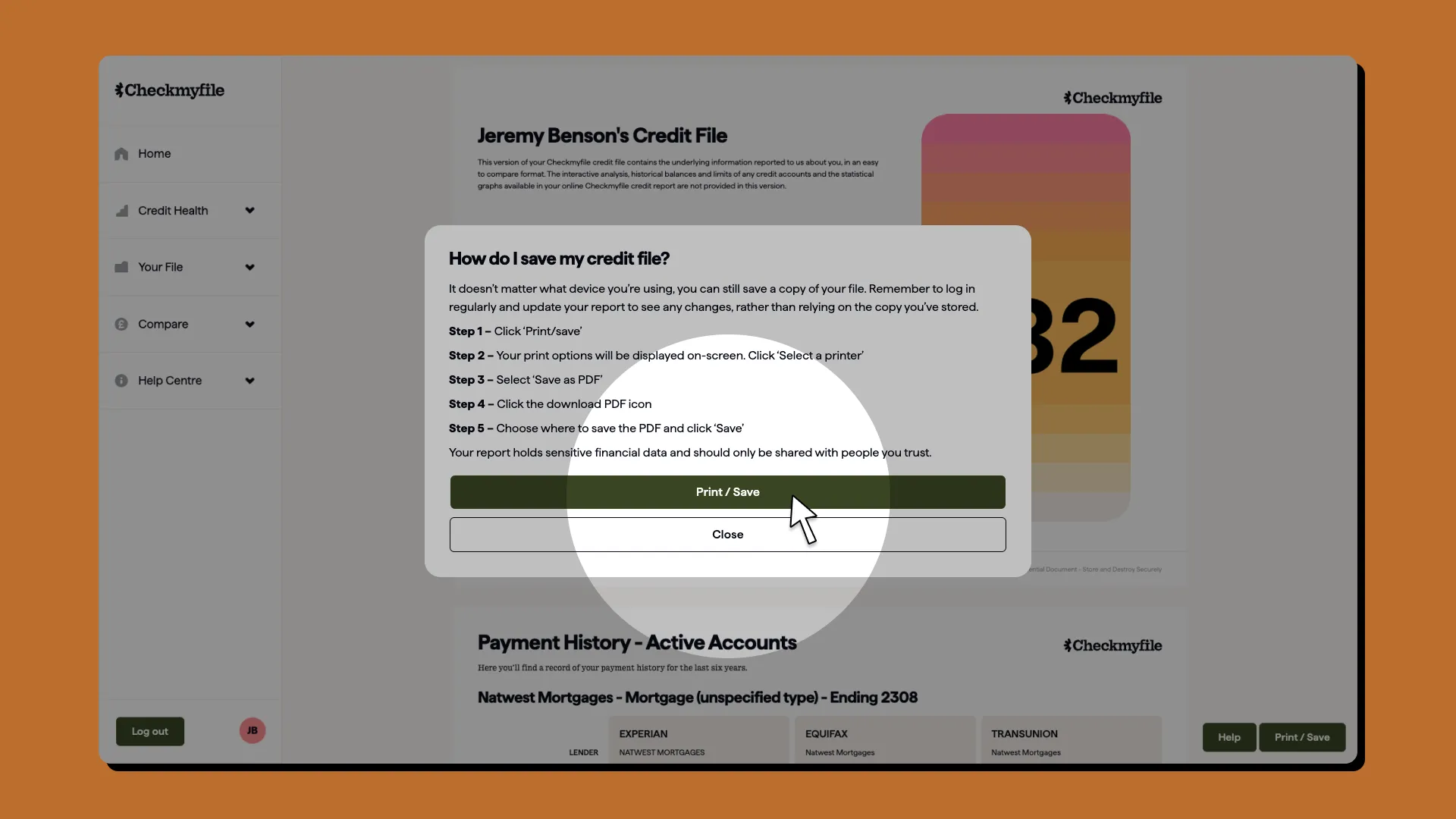

Step 2: Download your ‘printable report’

Once you’ve got your report, you’ll need to download a printable PDF version. You can find this at the bottom of the report - click the ‘download printable report’ button. If this button isn’t showing, get in touch with Checkmyfile through instant message or call 01872 304050 and they’ll look into it for you.

Once your report has been downloaded, you should be able to open the PDF document without the need of a password or code.

It’s super important to keep the PDF of your Credit Report secure. Make sure it’s stored safely on your computer or device.

Step 3: Send your credit report to your broker

If you’re happy to share the information on your Credit Report with your mortgage broker, you can do this now (this is entirely at your discretion and not a mandatory requirement).

Most mobile devices will give you the option to save the document or send it as an email attachment. You should have the email address for your broker or customer success team member - simply attach the file to the appropriate email address.

And you’re done! We’ll let you know once it’s received and if you need to do anything else.

Still confused? Take a look at our Guide: Checkmyfile Explained for a deeper look.

Information

Tools & Guides

Haysto, a trading style of Haysto Ltd, is an appointed representative of HL Partnership Limited, which is authorised and regulated by the Financial Conduct Authority.Registered Office: Haysto, Crystal House, 24 Cattle Market Street, Norwich, NR1 3DY. Registered in England and Wales No. 12527065

There may be a fee for mortgage advice. The exact amount depends upon your circumstances but will range from £599 to £1599 and this will be discussed and agreed with you at the earliest opportunity.

The guidance and/or information contained within this website is subject to the UK regulatory regime and is therefore targeted at consumers based in the UK.

Your home may be repossessed if you do not keep up repayments on your mortgage.