Bad Credit Mortgage Calculator

Got bad credit? You could still get a mortgage. We're specialist bad credit mortgage brokers with a proven track record of making homeownership possible for people like you. Use our mortgage calculator to discover how much you might be able to borrow, what your monthly repayments could be, and more!

How It Works

Three steps to make your mortgage possible - with expert guidance and an innovative process designed to support you every step of the way.

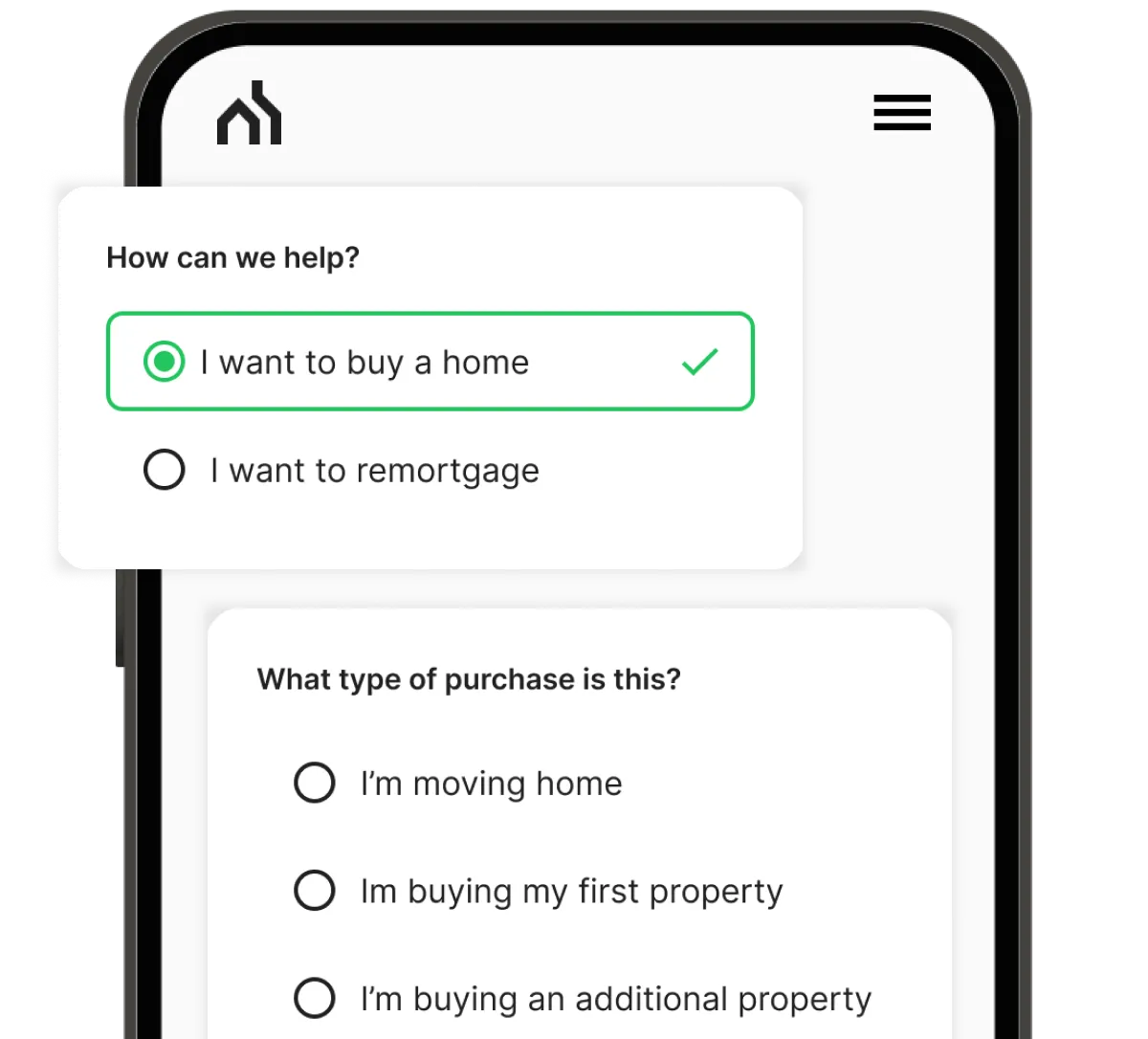

Get Started NowTell Us About You

Fill out a quick 60-second form about your unique situation. It won’t affect your credit score.

Mortgage Match

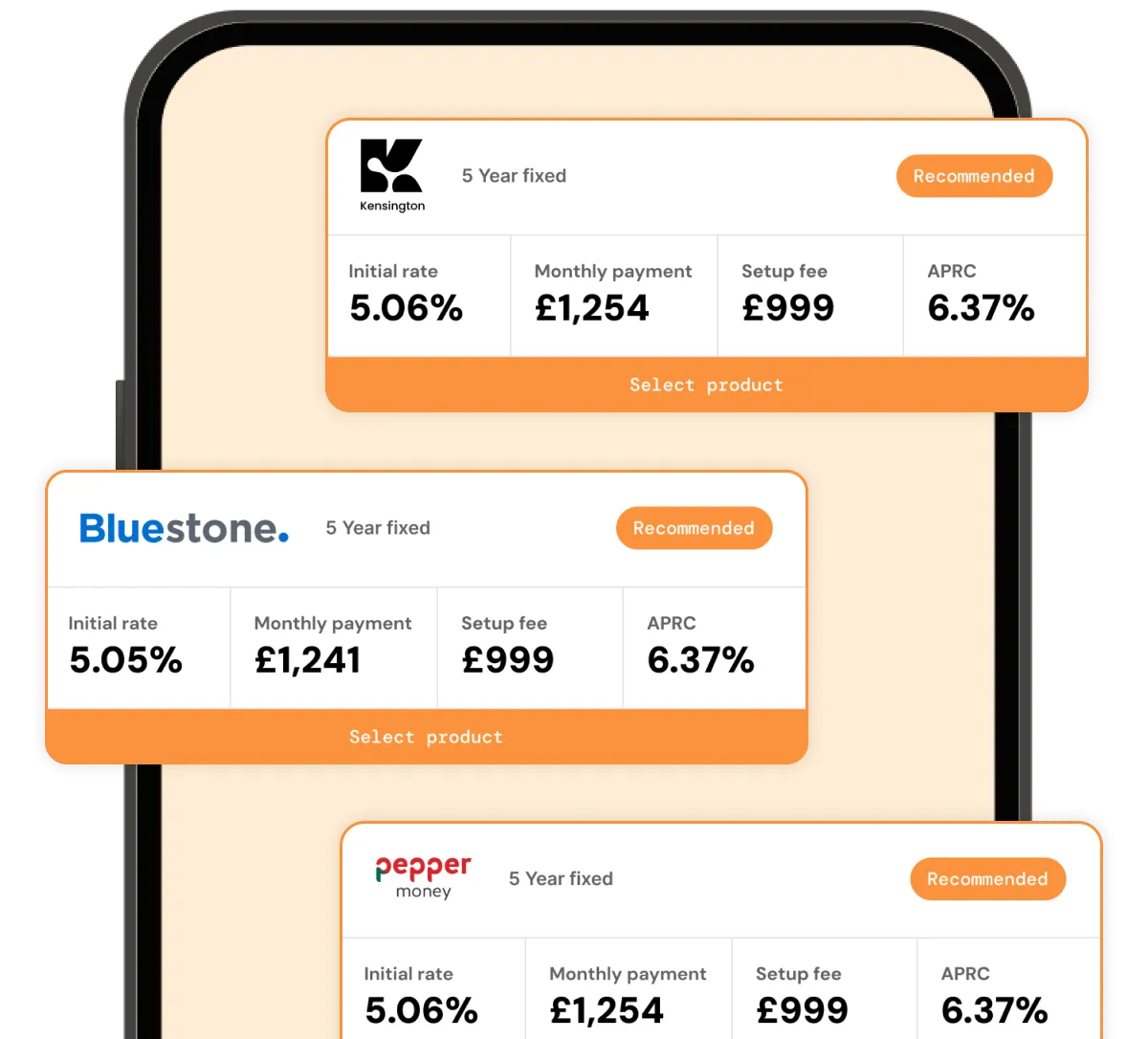

We have access to over 100 lenders, including options only available through specialist brokers, to find the best fit for you.

Meet Your Experts

Get paired with your dedicated team who'll handle everything from start to finish. Track progress 24/7 in your customer portal - no messy paperwork!

Any questions?

We're a judgement-free zone. If you still have questions, we've heard most of them before. Here are some of them answered by our team of experts.

Yes, it’s possible. It really all depends on the type of credit issue registered on your credit report, when it happened and how much the debt was for. Your choice of mortgage lender will also play an important part in whether your application is successful or not.

Read more about how this is possible in our guide: Getting a Mortgage With Bad Credit.

This will depend on the type of bad credit issue you’ve had and when it happened. For example, if you were only recently discharged from bankruptcy, your loan-to-value could be restricted, and you may need to make up the difference with a higher deposit, possibly up to 30% or 40%. But if you’ve had a late payment on your credit file from a number of years ago, then you may only need a 5% to 10% deposit.

To find out your credit score, we recommend using Checkmyfile* to examine your credit history thoroughly.

Checkmyfile’s credit report will show you information from the UK’s top three credit reference agencies: Experian, Equifax, and TransUnion. By taking a multi-agency approach, Checkmyfile’s credit report will help you see the difference in how the credit rating agencies view you.

Read our detailed Checkmyfile Explained guide to learn more.

*When you click through to our affiliate links, we may earn a small commission at no extra cost to you. We only recommend sites we truly trust and believe in.

Yes, it’s possible, but it may be slightly more difficult than if you had a perfect credit score. It all depends on the type of bad credit issue you’ve had since you originally took out your mortgage, how long since it happened, and the amount involved.

Read more in our guide: How to Remortgage With Bad Credit.

Yes, there are several specialist mortgage lenders who could look more favourably on applicants with bad credit. You won’t find them on the high street, but an experienced mortgage broker (like us!) will no exactly where to look.

Read more in our guide: Bad Credit Mortgage Lenders, and then make an enquiry to discuss your options with one of our Mortgage Experts.

Yes, it’s possible. It really depends on the severity of the credit issue you’ve had. The more severe issues will have a lower number of mortgage lenders available to consider your application, which means the interest rate you could be charged and the deposit you’ll need will likely be higher.

However, securing your mortgage at a slightly higher interest rate now could be worth it in the long run as you continue to repair your credit score and then possibly qualify for lower rates when you remortgage.

Information

Tools & Guides

Haysto, a trading style of Haysto Ltd, is an appointed representative of HL Partnership Limited, which is authorised and regulated by the Financial Conduct Authority.Registered Office: Haysto, Crystal House, 24 Cattle Market Street, Norwich, NR1 3DY. Registered in England and Wales No. 12527065

There may be a fee for mortgage advice. The exact amount depends upon your circumstances but will range from £599 to £1599 and this will be discussed and agreed with you at the earliest opportunity.

The guidance and/or information contained within this website is subject to the UK regulatory regime and is therefore targeted at consumers based in the UK.

Your home may be repossessed if you do not keep up repayments on your mortgage.