Mortgage Repayment Calculator

Want to know how much you might be able to borrow or how much your monthly repayments might be? You’re in the right place. Our mortgage repayment calculator estimates this and more - all without having to speak to anyone or enter your personal details.

How It Works

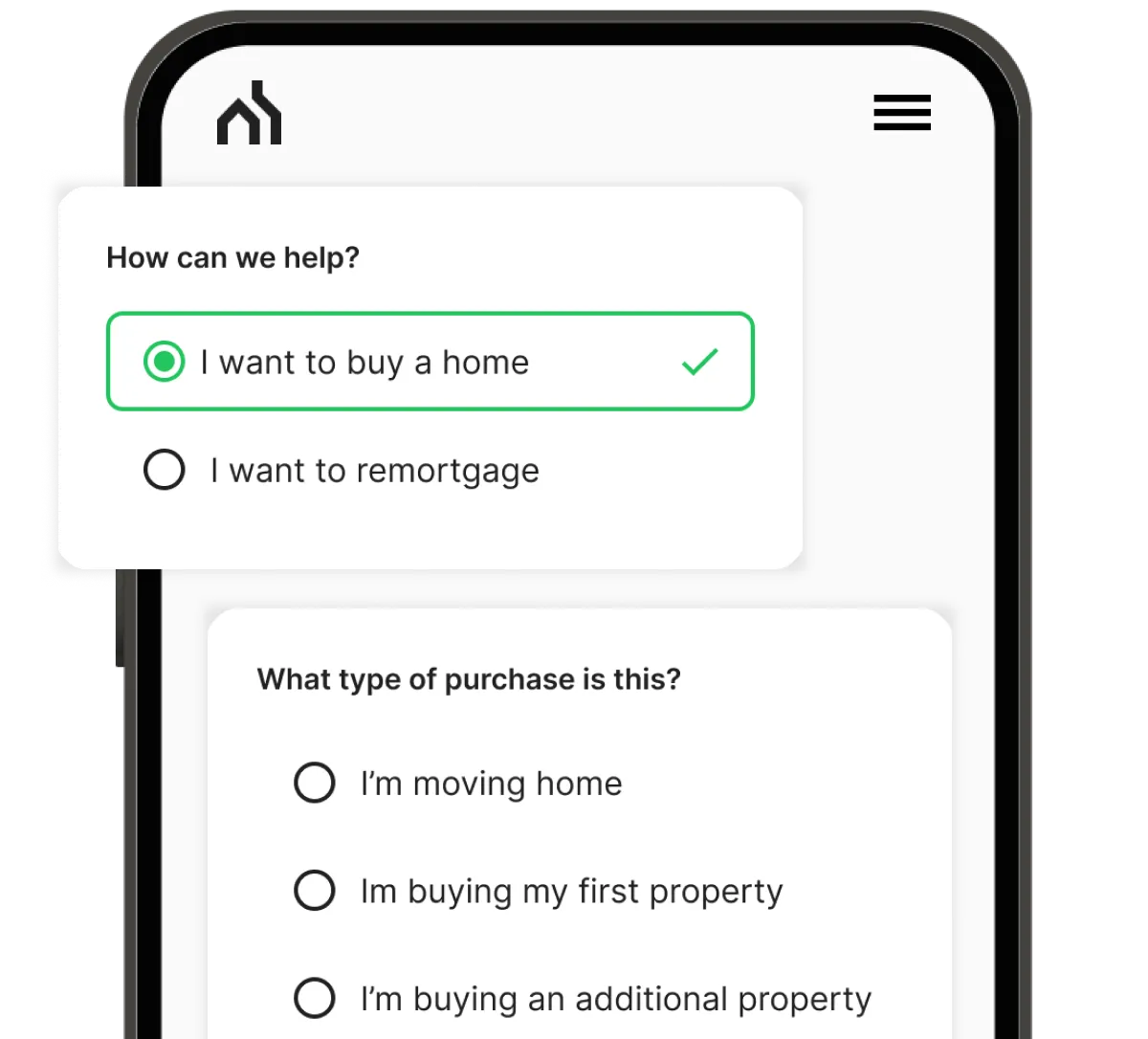

Three steps to make your mortgage possible - with expert guidance and an innovative process designed to support you every step of the way.

Get Started NowTell Us About You

Fill out a quick 60-second form about your unique situation. It won’t affect your credit score.

Mortgage Match

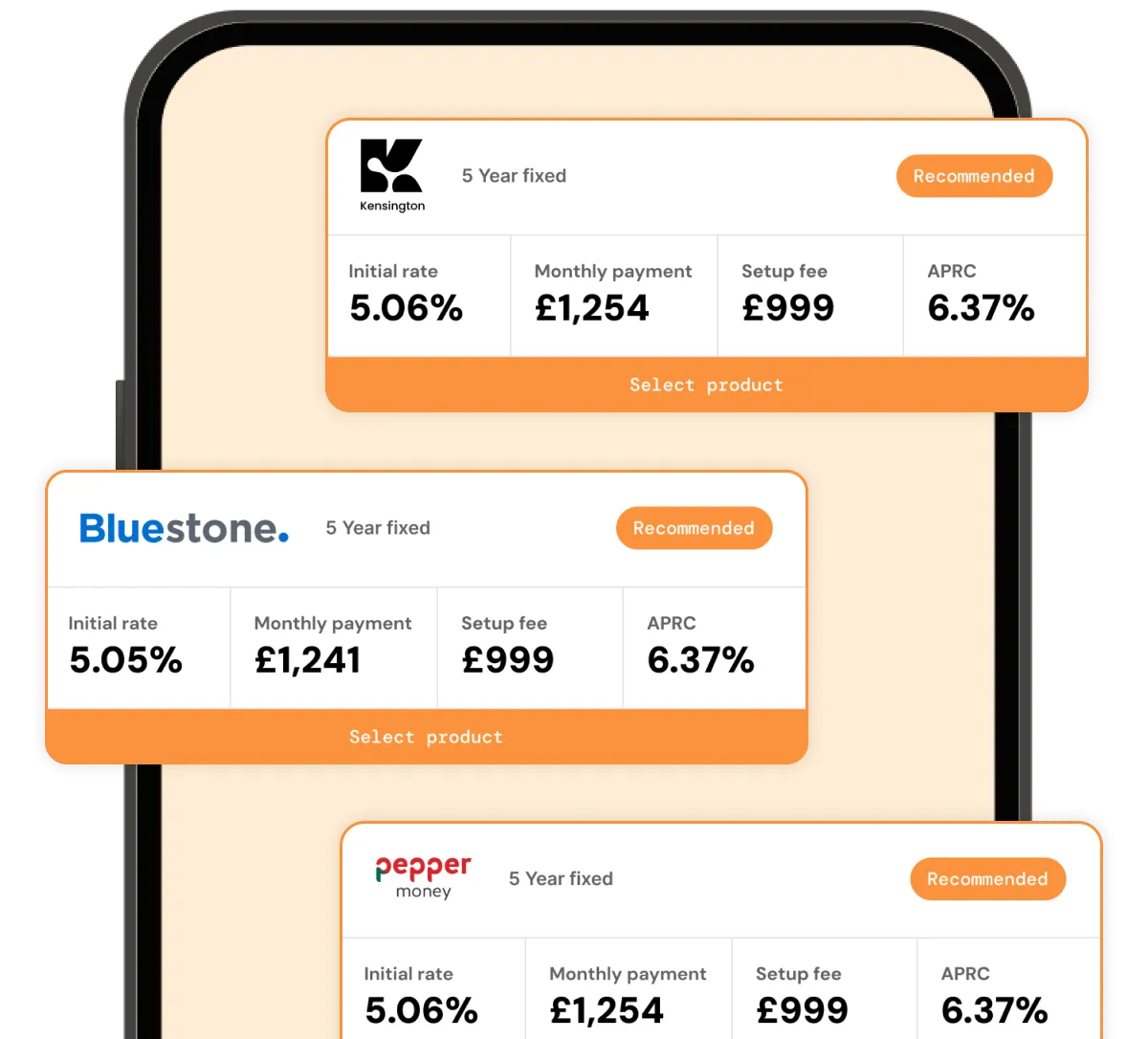

We have access to over 100 lenders, including options only available through specialist brokers, to find the best fit for you.

Meet Your Experts

Get paired with your dedicated team who'll handle everything from start to finish. Track progress 24/7 in your customer portal - no messy paperwork!

Any questions?

We're a judgement-free zone. If you still have questions, we've heard most of them before. Here are some of them answered by our team of experts.

When you're looking at different mortgage deals, small differences can have a big effect on what you pay.

A number of factors will impact what mortgage companies are willing to lend you. Your repayments will depend on:

How much you need to borrow

The size of your deposit

The interest rate your lender charges you

How many years you’ll need to repay the mortgage

Using our mortgage repayment calculator is a quick and easy way to give you an idea of your monthly repayments. Remember, these figures are a guide. Your exact repayments will depend on what mortgage you go for.

When you get a mortgage, the total loan amount your lender will offer you will be based on your affordability, the property value and the deposit you have. Mortgage companies use a formula to calculate your repayments:

The total loan amount ÷ the length of your mortgage term + the interest the lender will charge

For example:

The mortgage

You've borrowed £200,000

You've agreed to pay it back over 25 years

Your lender charges 4.5% interest in return for giving you the loan

The repayment

Over the next 25 years, you'll be charged £133,499 in interest

You'll need to pay back a total of £333,499

Your monthly repayment will be £1,112

Do you have an idea of your property price and want to know how much your monthly repayments will be? You’re in the right place. Use our handy mortgage repayment calculator to see what your monthly repayments might look like.

Mortgage repayments differ depending on how much you borrow, the size of your deposit, how much the property is worth, and the household incomings and outgoings. Because of this, it’s difficult to calculate an ‘average’ mortgage payment.

Like any loan, the interest rate is one of the most important factors when it comes to your mortgage repayments. The lower your interest rate, the lower your monthly repayments will be. Our Mortgage Experts can look at your options and find you a mortgage with the right interest rate for your needs. Make an enquiry.

How much you pay towards your mortgage each month will depend on the length of the mortgage term. People tend to repay their mortgage over 25 years, but recently 30-35 year mortgages have become more popular.

A longer mortgage is appealing because it lowers the amount you pay each month. This makes for a more affordable mortgage and makes it easier for you to get on the property ladder. You’ll need to bear in mind that the longer you take to pay off your mortgage, the more you’ll pay in interest over the years.

Interest-only mortgages mean you only pay back the interest charged on the money you've borrowed (capital). When you get to the end of your mortgage term after however many years, you'll then need to pay the capital (the actual loan amount) in full. With interest-only mortgages, you'll end up paying more interest than you would with a repayment mortgage because you won't be chipping away at the capital during your mortgage term.

To compare what your repayments would look like on the same property with interest-only and repayment mortgages:

Interest-only

You've borrowed £250,000

Your interest rate is 4.5%

You're paying it back over 25 years

Your repayments are £938 a month - a total of £281,400 paid in interest over the 25-year term

You’ll still need to pay back £250,000 at the end of the term

Repayment

Your repayments are £1,390 a month

You've paid a total of £166,874 in interest, and you've paid back everything you owe

Interest-only mortgages can be a good option if you’re looking to set more money aside for things like home improvements, if you don’t want to keep the property for a long time, or if you want to keep your initial payments lower before moving to a repayment mortgage.

If you apply for an interest-only mortgage, you’ll need to prove to the lender that you’ll be able to pay off the lump sum at the end. Most people who have interest-only mortgages have a repayment vehicle in place to repay the full capital amount at the end of the term.

If you can afford to overpay, it’s something you can consider. Before you do, you’ll need to check whether your particular mortgage allows for overpayments, and whether they’ll charge you an early repayment charge (ERC) first.

Some people choose to overpay in order to reduce the amount of interest they pay, and to get their mortgage paid off quicker.

The minimum deposit mortgage lenders usually accept is 5% of the property’s value. Most lenders prefer to ask for a deposit of between 10% to 15%, but this will vary from lender to lender.

You can read more about mortgage deposits in our guide: How Much Deposit Do I Need to Buy a House?

To get an Agreement in Principle, you need to give your mortgage broker or lender information about your finances. They will then give you an idea of how much you’ll be able to borrow. Read more in our guide: What is a Mortgage Decision in Principle?

If you have any kind of bad credit issues, are self-employed, or have a complicated situation, it’s best to work with a mortgage broker who can help you.

Our Mortgage Experts have access to a wide range of mortgages and could also have exclusive deals with lenders. They can help identify mortgage lenders who are most likely to accept you and prepare your mortgage application, saving you time, effort, and stress. Make an enquiry to find out your options.

Information

Tools & Guides

Haysto, a trading style of Haysto Ltd, is an appointed representative of HL Partnership Limited, which is authorised and regulated by the Financial Conduct Authority.Registered Office: Haysto, Crystal House, 24 Cattle Market Street, Norwich, NR1 3DY. Registered in England and Wales No. 12527065

There may be a fee for mortgage advice. The exact amount depends upon your circumstances but will range from £599 to £1599 and this will be discussed and agreed with you at the earliest opportunity.

The guidance and/or information contained within this website is subject to the UK regulatory regime and is therefore targeted at consumers based in the UK.

Your home may be repossessed if you do not keep up repayments on your mortgage.